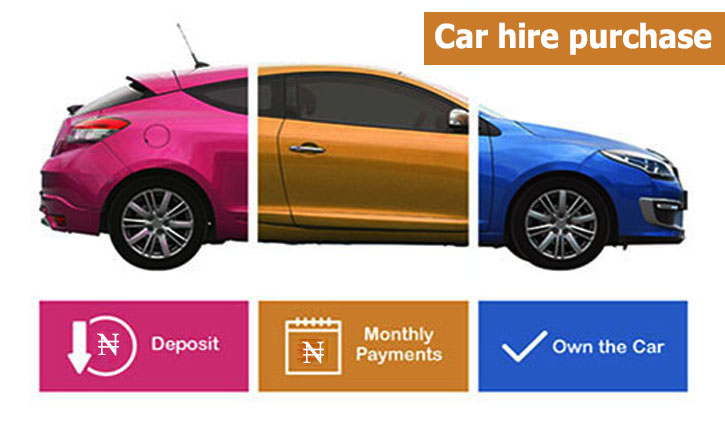

Car hire purchase is a car finance plan. After paying a relatively low deposit, you hire your car with the option to buy it by the end of the contract.

Table of Contents

Understanding Car hire purchase

Car hire purchase is a way someone buys a new or used car, you pay a deposit and pay off the value of the car in monthly instalments. This means you don’t own the vehicle until the last payment is made.

Buy top trending Car accessories in Lagos and Original Korea Battery now Check @carfanzy Lagos on Instagram

Pros of Car hire purchase

- Flexible repayment terms (from one to five years) to help fit in with your monthly budget – but the longer the term the more you’ll pay in interest.

- Relatively low deposit is required (usually 10% of the car’s price).

- Fixed interest rates so you know exactly what you’re paying every month for the length of the term.

- Once you’ve paid half the cost of the car, you might be able to return it and not have to make any more payments.

- If you don’t have a high credit score, it might be easier to get a hire purchase than an unsecured loan, as the car is used as collateral for the loan.

- It doesn’t usually come with mileage restrictions.

- You don’t need to find a large sum to purchase the car like with PCP.

Cons of Car hire purchase

- You don’t own the car until you’ve made your final payment, which means if you get into financial difficulties the finance company could take it away.

- You can’t sell or modify the car over the contract term without getting permission first.

- Monthly payments are usually higher than for PCP and leasing deals.

- Your deposit and term length will affect your monthly payments. Your monthly payments are likely to be higher the smaller the deposit is and the shorter the term of the loan.

- Until you’ve paid a third of the total amount payable, the lender can repossess the car without a court order.

- It can be an expensive route if you only want a short-term agreement.

How Car hire purchase works

Usually, you’ll first need to put down a deposit on the car you want for hire purchase. Most hire purchase agreements will be 10% or more of the vehicle’s value.

The rest of the value of the car will then be paid off in monthly instalments over a period of one to five years depending on the state of the agreement.

Hire purchase is arranged by the car dealer, but friends, businessmen or brokers can also offer this service. The rates are often very competitive for new cars, but less for used cars. For second-hand cars, the annual percentage rate can vary from 4%–8%. The lower the number the better.

Make sure you understand the terms and conditions of the hire purchase before signing the contract. For example, once all repayments have been made you pay a final fee, known as the ‘Option to Purchase’ – once you’ve paid this you’ll own the car. This is typical ₦70,000 – ₦100,000, but it does vary so ask how much it will be.

How to get the best hire purchase deal

There are two main options here:

- Getting the finance through the dealership you’re buying the car from

- Getting finance through an online broker.

It’s useful to search online first so you’re armed with some numbers to haggle within dealerships. Offers can vary significantly online and in dealerships so getting more than one quote is essential.

To help you compare the different offers, ask for:

- The APR you’ll be paying

- The total amount repayable

- The total cost of credit

- Any additional fees.

What to do if you can’t afford your repayments

If you’re struggling to meet your car finance payments, or simply want to cut costs, you can pay off the agreement early or return the car. But there are some conditions and costs attached to doing this, so don’t decide until you know exactly what they are.

Returning the car

If you’ve already paid half the cost of the car or make up the difference between what you’ve already paid and half of the car’s cost, you have the right to return the car to the finance provider under the Consumer Credit Act 1974. This is called ‘voluntary termination’.

Be aware you won’t get anything back if you paid more than half the cost of the car.

Returning the car might make sense if, for example, it had depreciated in value to the extent that your remaining payments would add up to more than its current value.

But, if the car’s current value is more than your remaining payments, you might be better off paying a settlement figure to the finance company and then selling the car.

Have 1 million naira and above to Buy or Sell Cars In Nigeria? Check Carmart.ng RIght Now

All rights reserved. Reproduction, publication, broadcasting, rewriting, or redistribution of this material and other digital content on carmart.ng is strictly prohibited without prior express written permission from Carmart Nigeria - Contact: [email protected]

Stay informed and ahead of the New Car info! Follow The Carmart Blog on WhatsApp for real-time updates, Cheap Cars, and Latest new car content. Don't miss Any –

Join The Carmart Blog Channel